The work from home concept is here to stay as flexibility to work from anywhere in the world is becoming a new standard. For operating teams and HR departments, this shift raises a vital question – how can you support a digital nomad without exposing your company to compliance, tax, or other legal issues? Well, that is what we are here to find out – how to ensure digital nomad compliance across the board. In this article we’ll dive into the key risks, gray areas, legal issues, and how to create a digital nomad policy that would keep your company safe from harm.

What is a Digital Nomad & Why it Matters to Employers?

The term digital nomad refers to freelancers who travel around and have flexible schedules. Even though the terms remote worker and digital nomad are getting blurred, they are vastly different, especially from a legal standpoint. An employee’s physical location carries much more weight than a company’s headquarters. That said, when an employee works from a different country, your business may be required to adhere to the country’s local laws and regulations. This is where it gets tricky and is exactly how risks start to multiply.

Legal Risks Related to Digital Nomads

The following legal risks apply to a company’s own employees who are on your payroll as these individuals are looking to work remotely from another country and travel a lot. So here is what that can lead to if the company fails to ensure proper digital nomad compliance policies:

1. Payroll Complexities & Tax Residencies

If an employee resides in the same country for too long, they might be considered as tax residents. What this means is that both the employee and you as a company become liable for the local social contributions and payroll taxes, regardless if you have already paid taxes in the company’s resident country. Conducting payroll and benefits audits is a vital component to ensure no complexities or issues arise at this point in the operation. For example, tax residency in the United Kingdom is triggered after 183 days, while in Switzerland an employee needs just 30 days of paid work for the local tax obligations to kick in.

2. Visa & Immigration Issues

Many digital nomads rely on tourist visas to travel. However, in many countries, it is illegal to work while being on a tourist visa, especially for foreign employers. That means mistakes like these can result in penalties or hefty fines for the employee, putting your company at a reputational risk. The solution would be to check the policies for a digital nomad visa in Europe for all employees who are seeking to actively move within the EU and reside there while working for your company.

3. Possible Employment Conflicts

When a person starts working in a new country, even if it is on a short term basis, the local labor laws can apply immediately. This may impact requirements about working hours, employment terms, notice periods, and vacation entitlements.

4. Data Protection Dangers

One of the biggest dangers of working as a digital nomad and complying is the risk of data loss. Working in a café within a country that has weak data protection laws and fails to properly adhere to GDPR equivalent standards, possess extreme dangers of having sensitive information leaked or hacked. In cases like this, there is a great need for training with strong technical controls and impeccable security over company devices and applications. For the employer, this means spending more energy on cybersecurity, increasing costs in the process.

5. Health & Safety Risks

A company’s duties for health and safety related risks remains in full effect, regardless if an employee works from a beach in Greece or from his home office. Before approving a digital nomad arrangement, it is vital to ensure liability insurance is in place within the destination country. Moreover, both the employer and employee need to take into account country specific risks, such as crime, political unrest, or infrastructural challenges.

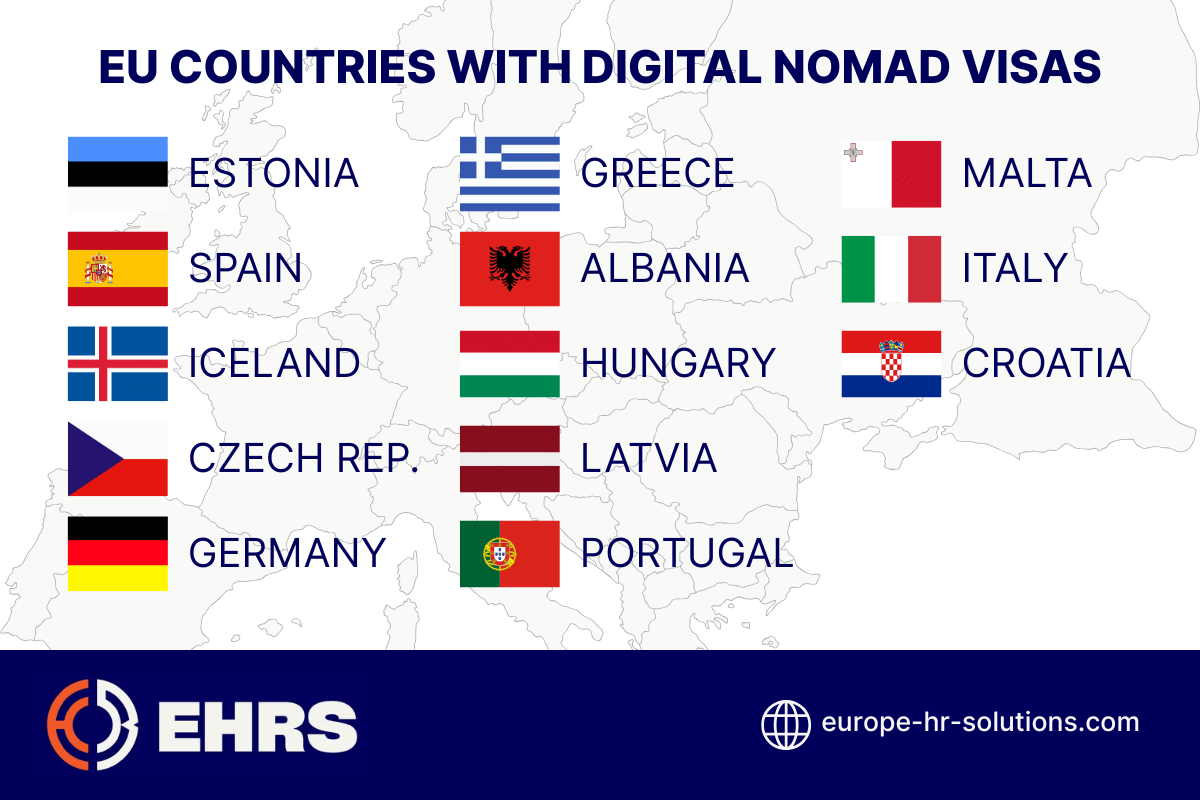

Which European Countries Have Digital Nomad Visas?

Many countries in Europe provide digital nomad visas, including the following:

- Estonia

- Spain

- Portugal

- Hungary

- Iceland

- Malta

- Italy

- Croatia

- Greece

- Czech Republic

- Latvia

- Germany

- Albania

European citizens who are living and working in other European countries can enjoy the freedom of moving around without a residence permit. However, the rules for non-EU citizens are different regarding digital nomad visas in Europe. Remote workers and digital nomads who are outside of Europe need to comply with the local residence laws of each country where they are planning to live and work in. Non-EU digital nomads have a 90 day limit to travel without a visa within the Schengen area. Non-US citizens from certain countries can also travel visa-free throughout the Schengen zone. That said, if they want to stay for longer, they’ll need to obtain the necessary visa to remain compliant with international laws. For example, recently Italy launched a visa that is tailor-made for digital nomads. Malta also offers a residence permit that is entirely suitable for digital nomads. Other freelancers and contractors, who are interested in a digital nomad lifestyle, can also apply. Though at first, it is advisable for individuals to understand what is a digital nomad lifestyle before venturing into this way of operating. Then they’ll need to meet specific requirements, and once approved, the permit will need to be renewed annually for up to 3 years.

How to Ensure Digital Nomad Compliance in the Workforce

Compliance is a vital component for all freelancers and contractors who fall under the digital nomad category on an international level. Non-compliance consequences vary by country and are severe, including paying hefty fines, getting deported, or even imprisonment. Due to these reasons, digital nomads need to adhere to all applicable laws in the country they want to reside in. Not all is doom and gloom, though, as there are various things to do in order to minimize these risks. Companies need to adhere to local labor laws and tax regulations when hiring independent contractors and digital nomads. These types of employees are unlike full time employees, as they themselves control how, where, and when they work. When contractors travel and work in different countries, generally, they are responsible for compliance adherence. However, local laws may vary, depending on the country of residence or the imposed tax rules and visa permits, and these can affect both the contractor and your company. For example, many companies make the same mistake of hiring digital nomads without formal policies. They rely on informal agreements and this leads to compliance issues. Without a set of specific and very clear guidelines, there are huge risks of tax penalties, misclassification, and legal disputes.

Bonus Point – Tax Compliance

Tax compliance is the most vital aspect for working with digital nomads. The key concept to be aware of here is the 183 day rule – a rule that countries use to determine tax residency and liability for income. This rule counts the number of days a remote worker spends in a country within a one year period. The specifics may vary by country, though digital nomads need to stay compliant nonetheless.

How to Create a Digital Nomad Policy

A company needs to establish clear remote work guidelines, procedures, and policies that would cover all financial, legal, and operation aspects before hiring digital nomads. To do so, here are some of the best practices:

- Written Contracts – having written contracts for all digital nomads that clearly define payment terms, confidentiality, project scope, and compliance with local laws will prevent misunderstandings

- Insurance – ensuring digital nomads carry appropriate insurance, like health coverage or liability will protect both parties from unexpected risks

- Code of Conduct – requiring independent contractors, including digital nomads, to sign a code of conduct outlining expectations for communication, professional behavior, data protection, and cybersecurity will save a lot of headaches

- Tax Compliance – clarifying tax responsibilities and setting up secure payment process will define the necessary guidelines for a smooth collaboration

To ensure digital nomad compliance, the company needs to create a digital nomad policy, which typically includes the following elements:

- Request & Approval Process – ensures you know who is working where and for how long, allowing you to evaluate legal risks

- Restricted Countries – identifies locations off-limits due to sanctions, safety concerns, or insurance limitations

- Work Environment Guidelines – encourages productivity by favoring coworking spaces over beaches or cafes to avoid distractions

- Work Hours & Time Zones – establishes collaboration windows that respect time zone differences without enforcing strict 9 to 5 rules

- Security Requirements – addresses the use of VPNs, safe practices on public Wi-Fi, and password protection to safeguard company data when working abroad

- Travel Duration Limits – limits stays in any one location often between 30 to 90 days to reduce tax and permanent establishment risks

- Insurance Disclaimers – clarifies coverage details and when employees must obtain additional insurance.

How We Can Help You

Our team can help you transition your operations into Europe, regardless if you are a small business owner or operate in a mid-size capacity. We pride ourselves in having our US and UK clients transition successfully by also teaching them how to understand and navigate the complexities and distinctions of European labor laws and employment regulations. We don’t just do the work, we make sure you understand the full extent of it so you can only reap the rewards! Here is where we come in with our leadership coaching programs for your in-house HR professionals, so they can implement continuous learning:

- Leadership development

- Leadership consulting

- Mentorship programs

- Functional training for HR professionals

- Compliance training for HR managers

How to Connect With Us

We know full-well and understand the importance for a solid foundation of an effective HR unit for any type of business. For those small or mid-sized North American companies that are looking to expand into Europe, we’ve got you covered! Our efficient support, innovative HR solutions, and expert team members, who have decades of experience in HR, allow us to provide the best strategies and solutions for your business’ needs. So don’t wait anymore, connect with us today and book a free consultation – the road to your successful expansion is just a click away!