Are your HR practices exposing your business to legal risks or operational inefficiencies? HR compliance audits have become a critical safeguard for organizations navigating intricate employment laws and evolving regulatory demands.

This comprehensive guide demystifies HR compliance audits, explaining their role in mitigating legal exposure, optimizing workplace policies, and aligning your practices with federal, state, and industry-specific requirements.

Whether you’re seeking to implement a proactive HR audit checklist, understand audit processes, or adopt compliance best practices, this guide delivers actionable insights to transform your HR operations into a risk-resilient, legally sound framework.

Key Statistics on HR Compliance Violations & Associated Penalties

| Violation Type | Description | Penalty/Statistical Impact |

| ADA Discrimination | Discrimination based on disability or failure to provide reasonable accommodation | $460,000 settlement in a reported case |

| FLSA Violations | Minimum wage, overtime, or recordkeeping failures | $30,000–$52,000 back wages per employee |

| Age Discrimination | Unlawful termination or hiring practices targeting older workers | $460,000 settlement in a reported case |

| Retaliation Complaints | Disciplinary actions against employees for filing HR-related claims | 48.8% of EEOC complaints in 2017 |

| OSHA Safety Violations | Failure to meet workplace safety standards | $10,000 fine per unresolved violation |

| Employee Misconduct Penalties | Unresolved unemployment claims affecting state tax rates | $4,000–$7,000 increased state tax over 3 years |

| Hiring Discrimination | Biased recruitment practices | $40,000 average settlement; up to $1M+ for litigious cases |

| Retirement Plan Non-Compliance | Failure to correct non-discrimination test failures | 10% excise tax on deposited amounts |

| Employee Turnover Costs | Loss of employees due to compliance or cultural failures | Up to 33% of an employee’s annual salary |

What is Human Resources Compliance Audit & Why It’s Important

HR compliance audits evaluate organizational adherence to employment laws, aiming to identify risks before they escalate. These systematic reviews ensure HR practices align with legal standards while optimizing operational efficiency through proactive risk mitigation.

Regulatory focus on HR practices has intensified due to evolving labor laws and increased reporting requirements. Modern organizations face stricter enforcement of anti-discrimination policies, wage regulations, and workplace safety mandates, making compliance audits essential for sustainable operations.

Regular audits yield operational benefits beyond legal protection. They streamline HR processes, reduce administrative redundancies, and enhance workforce management systems. Organizations implementing consistent audit practices often achieve improved policy implementation and measurable cost savings.

Proactive compliance audits systematically assess HR practices before issues arise, while reactive investigations address specific incidents. Proactive approaches prevent violations through regular reviews, whereas reactive methods respond to documented compliance failures or employee grievances.

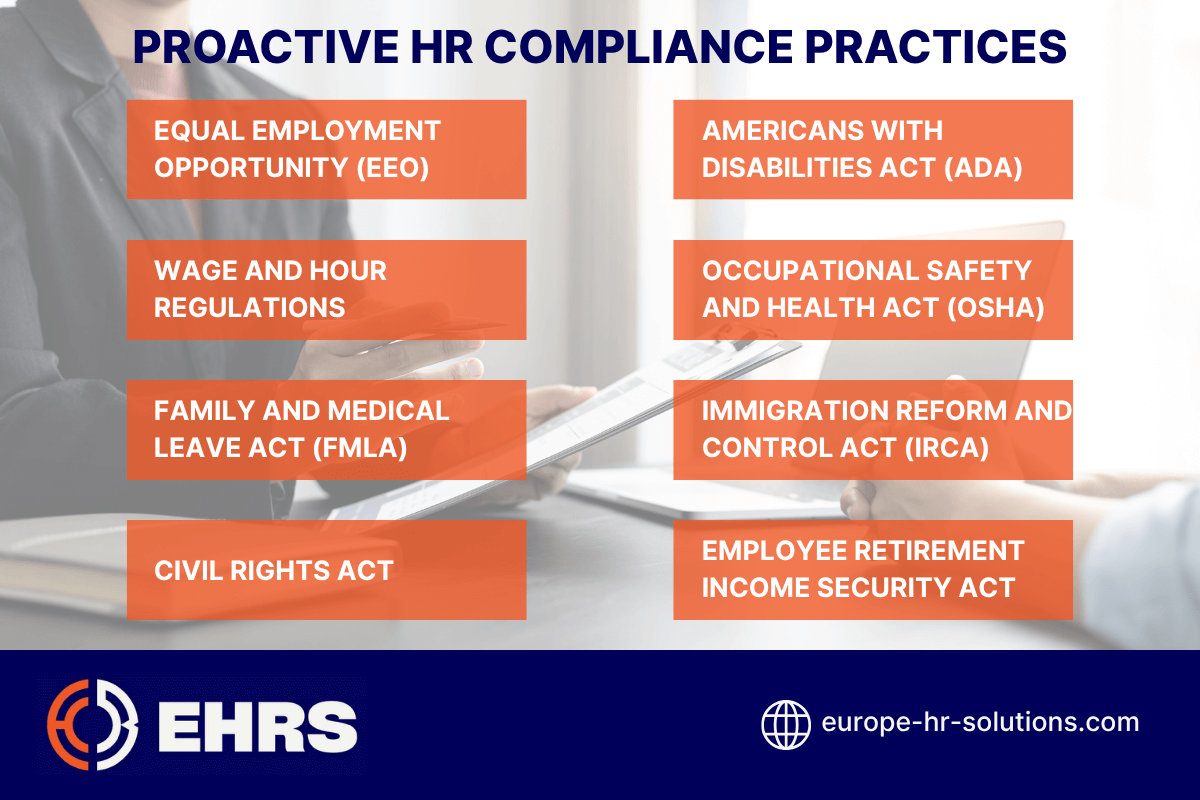

- Equal Employment Opportunity (EEO) laws prohibiting discrimination based on protected characteristics

- Wage and hour regulations governing minimum wage, overtime, and payroll practices

- Family and Medical Leave Act (FMLA) requirements for eligible employee leave entitlements

- Americans with Disabilities Act (ADA) mandates for reasonable accommodations and accessibility

- Occupational Safety and Health Act (OSHA) standards for workplace safety compliance

- Immigration Reform and Control Act (IRCA) provisions for work authorization verification

- Civil Rights Act protections against harassment and discriminatory practices

- Employee Retirement Income Security Act (ERISA) guidelines for benefits administration

HR compliance audits must address federal employment laws like the Fair Labor Standards Act, Equal Employment Opportunity regulations, and the Americans with Disabilities Act. These frameworks establish baseline obligations for wage practices, anti-discrimination policies, and workplace accessibility requirements.

State and local laws often create additional compliance layers, particularly for multi-jurisdiction employers. Variations in minimum wage rates, leave entitlements, and anti-harassment mandates require organizations to implement flexible HR frameworks that accommodate geographic regulatory differences.

Industry-specific compliance needs emerge in sectors like healthcare, finance, and government contracting. These fields demand specialized knowledge of HIPAA privacy rules, financial reporting standards, and affirmative action requirements for federal contractors.

Explore EU compliance challenges when standardizing global HR audits. International operations require balancing ILO guidelines with local labor codes, data privacy laws like GDPR, and cultural differences affecting workplace policies.

Types of HR Compliance Audits

Comprehensive HR audits systematically evaluate organizational adherence across all employment law domains. These assessments cover wage regulations, anti-discrimination policies, and documentation standards, typically conducted annually or biennially for mid-sized firms. External consultants often lead these reviews to maintain objectivity in regulatory interpretation.

Focused compliance audits target specific domains like payroll accuracy or leave management. These specialized reviews become necessary when regulatory changes affect niche areas or when incident patterns indicate systemic weaknesses. Their targeted nature enables faster resolution of high-risk compliance gaps compared to enterprise-wide assessments.

Pre-emptive risk assessments identify potential violations through scenario modeling and policy gap analyses. By simulating regulatory enforcement actions and analyzing historical compliance trends, these audits predict vulnerabilities before formal complaints emerge. Proactive organizations use this approach to strengthen policy frameworks proactively.

Post-incident investigative audits examine documented compliance failures following employee complaints or regulatory inquiries. Unlike routine reviews, these reactive assessments require forensic analysis of incident reports, witness statements, and corrective action documentation to determine root causes and prevent recurrence.

Discover GDPR-specific audit strategies for multinational compliance frameworks addressing data privacy alongside labor law requirements.

Key Areas Covered in HR Audits

Employee classification audits examine FLSA compliance by verifying job descriptions, payroll records, and timekeeping data. Misclassification risks include back pay liabilities and penalties. Auditors ensure proper documentation aligns with exemption criteria for exempt/non-exempt status.

Hiring practice reviews analyze application forms, interview notes, and background check protocols. Auditors flag questions about protected classes or medical history. Documentation must demonstrate adherence to anti-discrimination laws and proper I-9 verification processes.

Workplace policy evaluations assess handbooks for updated anti-harassment procedures, code of conduct standards, and safety protocols. Policies require annual reviews to reflect legal updates. Compliance hinges on clear communication, accessibility, and documented enforcement mechanisms for all employees.

Compensation audits scrutinize pay equity through job classification consistency and wage data analysis. Required benefits like Social Security contributions and workers’ compensation must align with jurisdictional mandates. Disparities emerge when market adjustments lack objective, non-discriminatory justification in payroll systems.

Regulatory Requirements for HR Compliance

Equal employment opportunity laws prohibit workplace discrimination based on protected characteristics. Auditors assess policy frameworks, training programs, and complaint resolution processes to verify non-discrimination compliance. Documentation like EEO-1 reports demonstrates adherence to federal anti-bias regulations.

Wage and hour laws mandate precise timekeeping records for payroll accuracy. Auditors examine payroll systems to confirm proper overtime calculations. Common violations involve misclassification of exempt employees or insufficient record retention, which can trigger back-pay liabilities.

FMLA compliance requires detailed leave documentation and eligibility tracking. Auditors verify proper notice postings and leave balance calculations. Common pitfalls include improper interference with leave rights and inadequate reinstatement procedures after protected absences.

ADA compliance focuses on reasonable accommodation documentation and accessibility measures. Auditors evaluate interactive process records and facility modifications. Good faith efforts involve documented discussions about potential accommodations and barrier removal in workplace environments.

HR Audit Process and Methodology

Audit planning establishes scope through regulatory priorities and organizational risk profiles. Internal stakeholders collaborate with HR leadership to determine whether assessments focus on federal mandates, state-specific requirements, or industry-specific obligations. Timelines range from 30-day focused reviews to multi-month comprehensive evaluations.

Data collection combines document analysis, employee interviews, and system audits. Reviewers examine payroll records, policy acknowledgments, and training logs while conducting stakeholder interviews. Digital platforms streamline evidence gathering through centralized document repositories and automated compliance tracking tools.

Compliance gaps emerge through benchmark comparisons and risk matrix evaluations. Analysts assess findings against legal standards, internal policies, and industry best practices. Risk levels receive quantification through potential financial exposure, litigation probability, and reputational damage projections.

- Employee handbook policies with annual review documentation and distribution records

- Policy acknowledgments signed by employees covering harassment, leave, and conduct

- Federal/state labor law postings updated quarterly in visible locations

- offboarding documentation

- Workplace training logs for harassment, safety, and legal compliance sessions

- Centralized employee files containing job descriptions, performance reviews, and corrective actions

- Job classification records with timekeeping data and wage compliance documentation

- Annual audit logs tracking handbook updates, policy changes, and system assessments

Employee records from hiring to termination require systematic management. Organizations must retain documents like I-9 forms, performance reviews, and payroll records. The EEOC mandates one-year retention for recruitment documents, while the FLSA requires three-year storage of payroll data to ensure regulatory alignment.

Confidential information and medical records demand strict access controls. Segregation of sensitive data prevents unauthorized access. Compliance frameworks dictate encrypted storage solutions and role-based permissions. Organizations must implement security protocols that meet both HIPAA standards and industry-specific data protection requirements for personnel information.

I-9 compliance verification ensures proper work authorization documentation. Auditors examine Form I-9 records for completion accuracy and timeliness. Non-compliance penalties include fines ranging from $230 to $2,332 per violation based on employer awareness and violation severity.

Electronic record systems must meet legal acceptability standards. Digital signatures require audit trails and tamper-evident protections. Ensure GDPR-compliant data handling by implementing dual verification methods and secure document retention periods.

Workplace Policies and Procedures

Employee handbooks must include anti-discrimination guidelines, leave entitlements, and accommodation procedures. Regular updates ensure alignment with evolving regulations, including state-specific requirements. Clear communication of these policies helps organizations demonstrate legal compliance during audits while establishing consistent workplace expectations.

Anti-harassment policies require documented reporting pathways and investigation protocols. Audits verify explicit definitions of prohibited conduct, accessible complaint mechanisms, and training records. Consistent enforcement prevents systemic issues while demonstrating organizational commitment to safe workplace environments through measurable compliance frameworks.

Disciplinary procedures need standardized documentation and equitable application across all employee groups. Auditors examine policy enforcement consistency, progressive discipline implementation, and defensibility of termination decisions. Inconsistent practices create legal exposure through disparate treatment patterns during compliance reviews.

Leave policies must align with federal, state, and local mandates like the FMLA. Audits assess proper documentation of leave requests, accurate eligibility determinations, and consistent reinstatement processes. Common pitfalls involve improper interference with protected leave rights and inadequate record-keeping for intermittent leave arrangements.

Review essential HR policies to ensure handbook alignment with current compliance requirements during workplace audits.

Wrapping Up

In an era of evolving regulations, HR compliance audits serve as essential safeguards against legal exposure while optimizing workforce management. Prioritizing employee classification accuracy, policy alignment with anti-discrimination laws, and meticulous documentation creates defensible processes. Organizations committing to routine audits position themselves not only to mitigate risks but to foster trust and operational resilience in competitive markets.

Frequently Asked Questions (FAQ)

What are the three levels of HR audit?

An HR audit typically focuses on three key areas: HR compliance, payroll and benefits compliance, and HR strategy. A phased approach, auditing each area separately over three years, allows for thorough data collection, analysis, and implementation of suggested changes.

This approach ensures that company policies align with current employment laws, recruitment processes comply with Equal Employment Opportunity (EEO) laws, and strategic HR opportunities are identified to drive organizational success by reviewing key metrics like employee turnover and engagement.

What are the 3 common methods to determine compliance?

HR compliance audits are comprehensive evaluations of an organization’s HR policies, procedures, and practices to ensure alignment with legal and regulatory requirements. There are generally three approaches to conducting these audits.

These include using an internal HR team, which is cost-effective but requires objectivity; engaging external HR consultants, who provide impartial expertise but can be more expensive; or consulting with legal counsel, particularly when complex legal issues or ongoing litigation are involved.

Which HR metric is analyzed in an HR audit?

An HR audit analyzes various metrics to assess the effectiveness of HR practices, providing insights into human capital management and its impact on organizational success. These metrics include recruitment and retention rates, such as time to hire, cost per hire, and employee turnover, which reflect the efficiency of hiring processes and employee satisfaction.

Additionally, revenue-related metrics like revenue per employee and billable hours per employee are examined, along with cost of HR per employee, absenteeism rates, and training expenses to evaluate overall HR efficiency and its contribution to the organization’s financial performance.

What are the three C’s in HR?

The “three C’s” in HR can refer to different concepts depending on the context. One interpretation emphasizes Culture, Competency (Capability), and Capacity, focusing on creating a supportive environment, ensuring employees have the necessary skills, and building strong relationships within the organization.

Another approach highlights Compensation, Career, and Culture, emphasizing employee retention by ensuring fair compensation, investing in professional development, and fostering a positive and inclusive company culture. The choice of interpretation depends on the organization’s goals.